Dreaming of sun-soaked beaches, ancient ruins, bustling metropolises, or serene mountain getaways? We all have places on our travel bucket list that we yearn to visit someday. However, turning these dreams into reality requires something more than just wanderlust; it necessitates a well-crafted financial strategy. Building a travel fund for your dream destinations can seem daunting, but with wise planning and disciplined saving, you can pave the way for your adventures.

Understanding the Basics of a Travel Fund

At its core, a travel fund is a dedicated savings pool set aside solely for your adventures. Think of it as your ticket to exploring the world without compromising your financial stability. Many people opt to create a separate bank account for this purpose, ensuring that these funds aren’t accidentally used for everyday expenses.

But what if you could grow your travel fund more substantially? Enter the concept of a self invested pension. Although traditionally used for retirement savings, a self invested pension can be a powerful tool for harnessing the power of compounded returns, potentially freeing up other income streams for your travel pursuits.

Setting Clear and Achievable Goals

The first step in building any savings fund is setting clear, actionable goals. Identify your dream destinations and research the average costs associated with them. Accommodation, flights, food, activities, and local transportation all contribute to the overall budget. Break your travels down into categories and allocate an estimated cost to each. Once you have a projected total, you can set smaller, manageable savings goals to reach over time.

Ambitious? Yes. Achievable? Absolutely!

Embrace the Power of Budgeting

A disciplined approach to budgeting can significantly accelerate your savings journey. First, track your regular monthly expenses and identify areas where you can cut back. Do you frequently eat out? How about those unused subscriptions? Redirecting funds from these areas into your travel fund can make a substantial difference.

Another effective strategy is the 50/30/20 rule for budgeting. This rule suggests splitting your income into three categories: 50% for needs, 30% for wants, and 20% for savings. By allocating part of that 20% to your travel fund, you ensure a steady flow of contributions.

Boost Your Income

While cutting down on expenses is effective, increasing your income can give your travel fund an even more significant boost. Consider taking on freelance work, part-time jobs, or even selling items you no longer need. Platforms like eBay, Gumtree, and Depop can help you declutter your home and earn some extra cash. Every little bit adds up and brings you one step closer to your dream destination.

Automate Your Savings

Automating your savings ensures consistency and removes the temptation to spend money earmarked for travel. Set up a direct debit to transfer a fixed amount from your main account to your travel fund regularly. Most banking apps in the UK offer easy-to-use features that allow you to automate these transfers. This ‘out of sight, out of mind’ approach can be incredibly effective.

Take Advantage of Travel Rewards Programmes

Many credit cards offer travel rewards such as air miles, hotel points, or cashback on travel-related purchases. Research and find a card that aligns with your travel plans and spending patterns. By using these cards responsibly and paying off the balance in full each month, you can accrue significant savings or rewards that directly contribute to your travel fund. Additionally, signing up for airline and hotel loyalty programmes can yield perks and discounts, further stretching your travel budget.

Stay Focused and Motivated

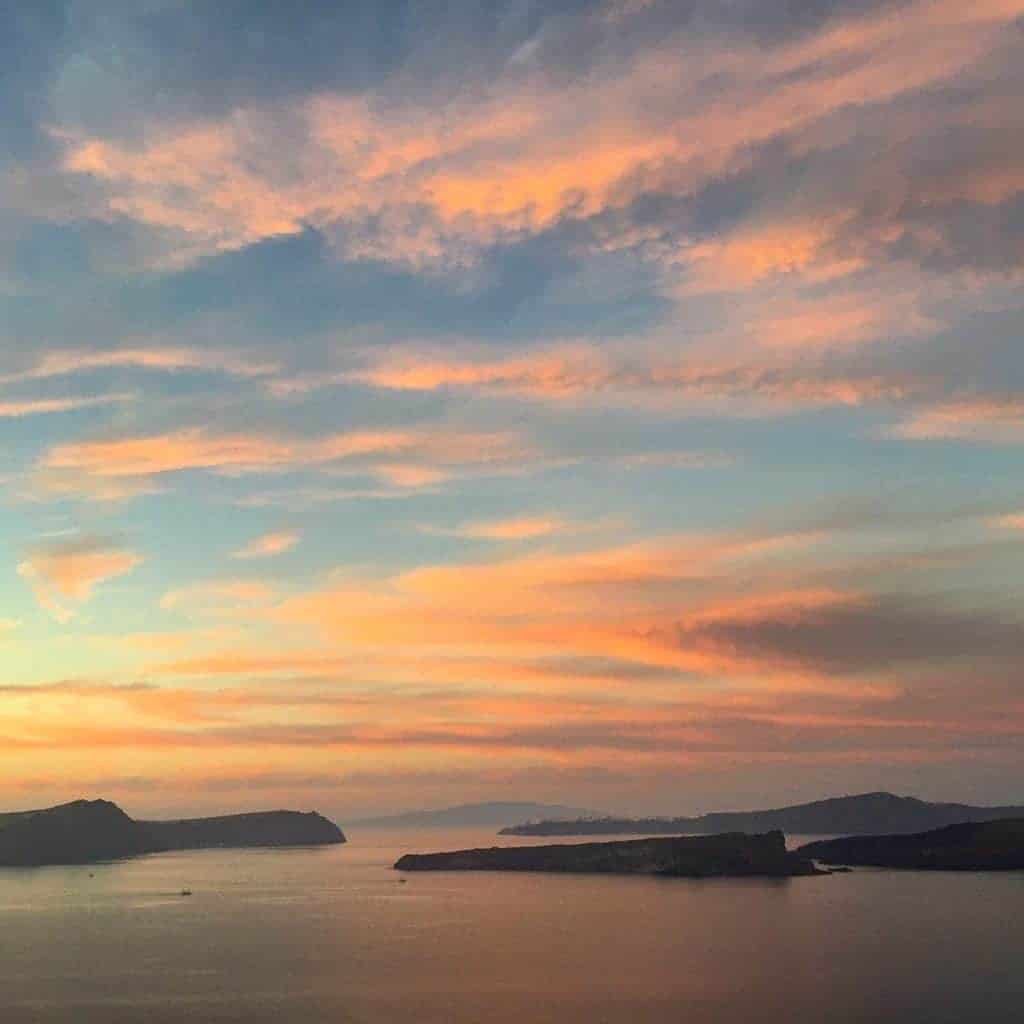

Saving for a big trip can be a long-term endeavour. It’s essential to stay motivated and keep the excitement of your destination at the forefront of your mind. Create a vision board with pictures and quotes about your dream destinations, or follow travel blogs and social media accounts that inspire you. Regularly remind yourself of the incredible experiences that await you, making every sacrificed luxury feel worthwhile.

Final Thoughts

Building a travel fund for your dream destinations requires a blend of smart budgeting, disciplined saving, and sometimes, creative income generation. Steady contributions, financial vigilance, and a clear vision of your travel goals can make the seemingly impossible dream of world travel a reality.

The world is full of breathtaking destinations waiting to be explored. With strategic planning and dedication, your travel fund can become the bridge between dreams and reality, ensuring you embark on those unforgettable journeys without financial worry. Safe travels!

Profesh traveling hot mess for 20 yrs

Profesh traveling hot mess for 20 yrs  Travel tips with fam & friends

Travel tips with fam & friends

Travel guides

Travel guides

)BIG PURE WANDER ANNOUNCEMENT! Fi

)BIG PURE WANDER ANNOUNCEMENT! Fi

There’s always

There’s always

SAVE THIS POST for your next Montana adventur

SAVE THIS POST for your next Montana adventur

SAVE this post for the next time you go int

SAVE this post for the next time you go int

SAVE For your next Newport, Rhode Island tr

SAVE For your next Newport, Rhode Island tr

SEND this to someone who needs a WINK WINK NU

SEND this to someone who needs a WINK WINK NU